At the end of Disney/Pixar’s “Finding Nemo,” a group of fish escape from their tank by jumping into plastic bags that are filled with water and then securely tied at the top. After hopping out of a window, they cross a busy street and land safely in the waters of Sydney Harbour. Still in a plastic bag and bobbing up and down on the water, one of the fish asks an important question: “Now what?” The whole point of escaping was to obtain freedom from captivity. Similarly, the whole point of obtaining a federal oil and gas lease is to produce the natural resources on which our nation relies. To do so, however, requires obtaining the necessary surface use authorizations, which can be complicated.

Lease Rights

The current form of federal oil and gas lease[1] grants to the lessee “the exclusive right to drill for, mine, extract, remove and dispose of all the oil and gas (except helium) [in the leased lands] together with the right to build and maintain necessary improvements . . . .”[2] Those rights, however, are “subject to applicable laws, the terms, conditions, and attached stipulations of [the] lease, the Secretary of the Interior’s regulations and formal orders in effect as of lease issuance, and to regulations and formal orders [promulgated after lease issuance] when not inconsistent with lease rights granted or specific provisions of [the] lease.”[3] That’s where things get complicated.

As mentioned, federal oil and gas leases are subject to “applicable laws.” Generally, this means federal laws, such as the National Environmental Policy Act (NEPA)[4] and Endangered Species Act,[5] which can significantly impact a lessee’s ability to access federal oil and gas. There are several other laws that may apply to the extraction of federal oil and gas, including state laws and local ordinances, and operators should consult with competent legal counsel when evaluating their compliance with all applicable laws.

Compliance must also be made with the terms and conditions of the lease. The current form of lease and current regulations, for example, require a bond for lease operations. This requirement can be satisfied by obtaining a lease bond (at least $10,000), a statewide bond (at least $25,000), or a nationwide bond (at least $150,000). An operator may apply for partial release of a lease bond as reclamation operations are completed. Partial release is not available for statewide or nationwide bonds.

Another example of lease terms and conditions is the “conduct of operations” section of the current lease form. This section requires the lessee to “conduct operations in a manner that minimizes adverse impacts to the land, air, and water, to cultural, biological, visual, and other resources, and to other land uses or users.” These requirements can express themselves in many ways. The BLM (and FS) have published generally applicable standards and guidelines for operators engaged in the production of federal oil and gas, commonly known as “The Gold Book,” which provides an indication of how the BLM may require operations to be conducted.[6]

As noted, a federal oil and gas lease is also subject to any attached stipulations. The specific stipulations will depend on the characteristics of the leased lands. By way of example, those stipulations may include, but are certainly not limited to, restrictions on operations due to (1) threatened, endangered, and special status species; (2) animal breeding or nesting sites; (3) protection of cultural resources; (4) congressionally designated historic trails; and (5) avoidance of conflicts due to multiple mineral development. The restrictions may sometimes be seasonal or only applicable during a certain time of day. It is important to carefully review all of the stipulations attached to your lease to ensure that your proposed operations can comply with them.

The Secretary of the Interior has also published regulations, formal orders, and “Notices to Lessees” that govern access to federal oil and gas. Many of the relevant regulations can be found in 43 CFR Part 3160, et seq. There are currently seven “Onshore Oil and Gas Orders” that govern federal oil and gas operations, including Onshore Order No. 1 (approval of operations); Onshore Order No. 2 (drilling); and Onshore Order No. 3 (site security). There are currently two National Notices to Lessees (NTLs) promulgated by the BLM, which govern the reporting of undesirable events and royalty or compensation for oil and gas lost, as well as one Utah-specific NTL regarding the standards for use of electronic flow computers in gas measurement.[7]

The surface access rights granted under a federal oil and gas lease only apply to operations on the leased lands or lands that are unitized therewith and are authorized as part of an Application for Permit to Drill (APD), as discussed below. For operations outside of the leased lands or unit, a right-of-way, permit, or other authorization will need to be obtained from the federal government, the state government, or private surface owner(s), as applicable.

Permitting and Approval of Lease Operations

The earlier you can start the process of gaining access to federal oil and gas, the better. Early coordination with the BLM during the planning stages can help bring to light site-specific issues and local requirements, which generally leads to a more efficient permit approval process. In addition to a BLM-approved APD, an operator will need to obtain any approvals required by other federal, Tribal, state, or local authorities, which can also take some time.

There are additional considerations that apply in split-estate situations (non-federal surface over federal oil and gas). When split-estate is involved, an operator must make a good faith effort to notify the surface owner before entering the land to conduct surveys or stake a well location. An operator is also required to make a good-faith effort to negotiate a surface use agreement (SUA) with the surface owner. If negotiations are not successful, then a separate bond will be required as part of APD approval. The bond must be at least $1,000 and is designed to compensate the surface owner for reasonable and foreseeable loss of crops and damage to improvements. If the surface owner objects to the amount of the bond, then the BLM will review and either confirm the previously established bond amount or set a new amount.

Geophysical operations involving federal oil and gas are considered lease operations that may be performed on a federal lease after filing a Sundry Notice[8] or Notice of Intent and Authorization to Conduct Oil and Gas Geophysical Exploration Operations (Notice of Intent)[9] with the BLM. The party filing the Notice of Intent will need to be bonded. The BLM may require cultural resource or threatened/endangered species surveys for geophysical operations that will involve surface disturbance. BLM approval is not necessary for geophysical operations involving federal oil and gas under fee or state surface. In that case, an operator must work with the fee surface owner or relevant state agency to obtain access to the lands.

Surveying and staking can take place before approval of an APD, but APD approval is required before drilling and any related surface-disturbing operations. To apply for a permit to drill, an operator has two options: (1) file a Notice of Staking (NOS), followed by an APD; or (2) file an APD only. An NOS is a formal request for an onsite inspection[10] prior to filing an APD and it initiates the 30-day posting period that the BLM is required to follow before approving an APD. Filing an NOS can be particularly useful if the operator anticipates concerns that will eventually need to be addressed in an APD. The BLM has published a sample form of NOS,[11] but no specific form is required.

A completed APD package includes (1) APD Form 3160-3;[12] (2) a well plat certified by a registered surveyor; (3) a Drilling Plan; (4) a Surface Use Plan of Operations (including a reclamation plan);[13] (5) evidence of bond coverage; (6) operator certification in accordance with the requirements of Onshore Order No. 1; and (7) any other information required by order, notice, or regulation. An operator may file a Master Development Plan for multiple wells within a single Drilling Plan and Surface Use Plan of Operations, but an APD and survey plat still have to be submitted for each individual well. Changes to plans reflected in an APD must be submitted for BLM approval by filing a Sundry Notice. After the well is completed, a Well Completion Report[14] must be filed. As of March 13, 2017, all of these filings must be done through the BLM’s electronic filing system.

The BLM is charged with the responsibility of ensuring compliance with NEPA. When evaluating an APD, the BLM will conduct an Environmental Assessment (EA), if one has not already been done, and issue a decision in that regard. Issues raised by an EA may prompt a more-comprehensive Environmental Impact Study, delay approval of an APD, or result in stipulations or conditions of approval in addition to those that are attached to the lease.

Before approving an APD, the BLM will also conduct an onsite inspection (whether initiated as part of an NOS or APD) to identify site-specific issues and requirements. The BLM will notify the operator if any cultural resource studies or threatened or endangered species studies will be required. The operator, any parties associated with the planning of a drilling project (such as the operator’s dirtwork contractor or drilling contractor), and the fee surface owner, if any, will be invited to attend the onsite inspection.

If an operator desires to request a variance from the requirements of an onshore order, or an exception, waiver, or modification of a stipulation attached to a lease, then a request may be filed with the BLM, explaining the basis for the variance and how the intent of the onshore order will be satisfied, or the reason(s) why the stipulation is no longer justified.

[1] For purposes of this article, “federal” refers to federal government lands administered exclusively by the Bureau of Land Management (the “BLM”), as opposed to the United States Department of Agriculture, Forest Service (the “FS”), other surface management agencies, or the Bureau of Indian Affairs (the “BIA”). While the BLM works with the BIA, FS, and other surface management agencies in administering the lands within their stewardship, the nuances relating to the lands of those other agencies are not addressed in this article.

[2] Form 3100-11, Offer to Lease and Lease for Oil and Gas, available at https://www.blm.gov/sites/blm.gov/files/uploads/Services_National-Operations-Center_Eforms_Fluid-and-Solid-Minerals_3100-011.pdf.

[3] Id.

[4] See 42 U.S.C. § 4321, et seq.

[5] See 16 U.S.C. § 1531, et seq.

[6] See, e.g., Surface Operating Standards and Guidelines for Oil and Gas Exploration and Development, United States Department of the Interior and United States Department of Agriculture, 2007, p. 41 (regarding painting of facilities), available at https://www.blm.gov/programs/energy-and-minerals/oil-and-gas/operations-and-production/the-gold-book (The Gold Book).

[7] Links to the regulations, onshore orders, and NTLs are available at blm.gov.

[8] Form 3160-5, available at https://www.blm.gov/sites/blm.gov/files/uploads/Services_National-Operations-Center_Eforms_Fluid-and-Solid-Minerals_3160-005.pdf.

[9] Form 3150-4, available at https://www.blm.gov/sites/blm.gov/files/uploads/Services_National-Operations-Center_Eforms_Fluid-and-Solid-Minerals_3150-004.pdf.

[10] The BLM has 10 days to schedule an onsite inspection after receiving an NOS or APD, but there is no deadline for when the inspection itself must to take place.

[11] See The Gold Book, p. 61.

[12] Available at https://www.blm.gov/sites/blm.gov/files/uploads/Services_National-Operations-Center_Eforms_Fluid-and-Solid-Minerals_3160-003.pdf.

[13] In a split-estate situation, an operator must make a good-faith effort to provide the surface owner with copies of (1) the Surface Use Plan of Operations; (2) the approved APD with its conditions of approval; and (3) any proposals involving new surface disturbance.

[14] Form 3160-4, available at https://www.blm.gov/sites/blm.gov/files/3160-004.pdf.

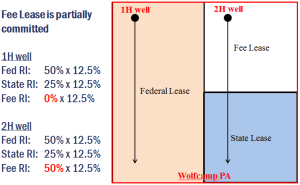

So what happens if the lessee’s working interest is committed to the unit agreement, but the lessor’s royalty interest is not? While the lessee will be allocated proceeds according to its proportionate share of the unit production area, the lessor will be allocated proceeds on a leasehold basis. This can result in a windfall either for the lessor or the lessee (compare the allocation of proceeds from the 1H and 2H wells in the diagram to the right, assuming 320 acre standup spacing units).

So what happens if the lessee’s working interest is committed to the unit agreement, but the lessor’s royalty interest is not? While the lessee will be allocated proceeds according to its proportionate share of the unit production area, the lessor will be allocated proceeds on a leasehold basis. This can result in a windfall either for the lessor or the lessee (compare the allocation of proceeds from the 1H and 2H wells in the diagram to the right, assuming 320 acre standup spacing units).