On this blog, we have posted our complete Fee Lease 101 Series covering many of the standard fee oil and gas lease provisions from the granting clause to the pooling clause. However, there is typically a group of clauses towards the end of the lease form that appear to be the left-over clauses. These clauses include the assignment clause, proportionate reduction clause, warranty clause, surrender or release clause, and preferential right to purchase or option clause. They can have important ramifications on the relationship of the lessor and lessee and status of the lease and, accordingly, are discussed below.

I. Assignment Clause

The assignment clause governs how the lessor and lessee may assign their respective interests. It may contain a restraint on the lessee’s power to assign the lease in whole or in part without the lessor’s consent. It may also contain a restraint on the minimum acres or minimum interest that may be assigned, such as “no less than forty acres” or “no less than the lessee’s entire undivided interest.” This restraint on assigning/alienation by the lessee is generally allowed; however, it will be strictly construed.

To avoid a claim that the clause is an unreasonable restraint on alienation, contemporary leases typically authorize assignments by either the lessor or lessee, in whole or in part, but will often include conditions to the assignment. For instance, it may state that lessee will not recognize a change in the lessor’s ownership until it receives an original or authenticated copy of the assignment. It may allow a partial assignment by the lessor, but will require that the assignment cannot increase the lessee’s obligations under the lease, such as drilling offsetting wells, protection of drainage, requiring separate measuring, or installation of separate tanks.

Although often the intent of the assignor, it is important that the assignment clause provides that the lessor relieves the lessee of any further obligations concerning the interest assigned.1 The assignor does not want to assign the interest and thereafter be stuck with the royalty payments if the assignee fails to pay the lessor. If a partial assignment of the lessee’s interest is allowed, a provision should be included that deals with the apportionment of rentals and royalties.

The following example assignment clause addresses all of the above requirements:

Ownership Changes. The interest of either Lessor or Lessee hereunder may be assigned, devised or otherwise transferred in whole or in part, by area and/or by depth or zone, and the rights and obligations of the parties hereunder shall extend to their respective heirs, devisees, executors, administrators, successor and assigns. No change in Lessor’s ownership shall have the effect of reducing the rights or enlarging the obligations of Lessee hereunder, and no change in ownership shall be binding on Lessee until 60 days after Lessee has been furnished the original or duly authenticated copies of the documents establishing such change of ownership to the satisfaction of Lessee or until Lessor has satisfied the notification requirements contained in Lessee’s usual form of division order. In the event of death of any person entitled to rentals or shut-in royalties hereunder, Lessee may pay or tender such rentals or shut-in royalties to such persons or to their credit in the depository, either jointly, or separately in proportion to the interest which each owns. If Lessee transfers its interest hereunder in whole or in part Lessee shall be relieved of all obligations thereafter arising with respect to the transferred interest, and failure of the transferee to satisfy such obligations with respect to the transferred interest shall not affect the rights of Lessee with respect to any interest not so transferred. If Lessee transfers a full or undivided interest in all or any portion of the area covered by this lease, the obligation to pay or tender rentals and shut-in royalties hereunder shall be divided between Lessee and the transferee in proportion to the net acreage interest in this lease then held by each.2

II. Proportionate Reduction3

The proportionate reduction clause is also referred to as the lesser interest clause. It provides for reduction of rentals and royalties owed to the lessor in the event the lessor owns less than the full mineral estate. A typical proportionate reduction clause will provide:

In case said Lessor owns a lesser interest in the above described land than the entire and undivided fee simple estate therein, then the rentals and royalties herein provided shall be paid to Lessor only in the proportion that his interest bears to the whole and undivided fee.

However, the above example does not differentiate between the proportionate reduction of rentals and proportionate reduction of royalties. It focuses on the entire leased lands. What is the result if the lease covers a 640-acre section, the lessor owns 100% of the mineral estate in the W/2 of the section, 50% of the mineral estate in the E/2 of the section, and the well is located on the E/2? The lessor’s proportionate interest is 75% [(100% x 320/640) + (50% x 320/640)]. The lessor would not only receive 75% of the rental, but also 75% of the royalty even though the well is located on the lands in which the lessor only owns a 50% mineral interest.

The following example makes a distinction between rentals and royalties:

If Lessor owns less than the full mineral estate in all or any part of the leased premises, payment of rentals, royalties, and shut-in royalties hereunder shall be reduced as follows: (a) rentals shall be reduced to the proportion that Lessor’s interest in the entire leased premises bears to the full mineral estate in the leased premises, calculated on a net acreage basis; and (b) royalties and shut-in royalties for any well on any part of the leased premises or lands pooled therewith shall be reduced to the proportion that Lessor’s interest in such part of the leased premises bears to the full mineral estate in such part of the leased premises.

III. Warranty Clause4

The warranty clause provides a warranty of title by the lessor with respect to the interest described in the granting clause. Additionally, the warranty clause provides the basis for applying the doctrine of after-acquired title in the event the lessor acquires an interest in the leased premises after giving the lease. The following are two examples of warranty clauses:

- Lessor hereby warrants and agrees to defend the title to the land herein described and agrees that the Lessee, at its option may pay and discharge in whole or in part any taxes, mortgages, or other liens existing, levied, or assessed on or against the above described lands, and in the event it exercises such option, it shall be subrogated to the rights of any holder or holders thereof and may reimburse itself by applying the discharge of any such mortgage, tax, or other liens, to any royalty or rental accruing hereunder.

- Lessor hereby warrants and agrees to defend title conveyed to Lessee hereunder, and agrees that the Lessee at Lessee’s option may pay and discharge any taxes, mortgages or liens existing, levied or assessed on or against the leased premises. If Lessee exercises such option, Lessee shall be subrogated to the rights of the party to whom payment is made, and, in addition to its other rights, may reimburse itself out of any royalties or shut-in royalties otherwise payable to Lessor hereunder. In the event Lessee is made aware of any claim inconsistent with Lessor’s title, Lessee may suspend the payment of royalties and shut-in royalties hereunder, without interest, until Lessee has been furnished satisfactory evidence that such claim has been resolved.5

The second warranty clause above allows the lessee to suspend payments to the lessor without interest in the event of a title dispute. However, a lessee should never suspend rental payments even if there is a title dispute. Failure to pay rentals could be fatal if the suspension is later determined to be unjustified.

As set forth in the above examples, the warranty clause often will contain a subrogation provision pertaining to a superior lien existing prior to the execution of the lease. To protect the lessee from the lease being extinguished if the superior lien is foreclosed, the clause authorizes the lessee to satisfy any liens and be subrogated to the rights of the lienor. The clause may vary in the types of claims or obligations the lessee is authorized to satisfy, including mortgages, deeds of trusts, taxes, assessment, charges, and encumbrances. Additionally, the clause may address whether the lessee may satisfy the claim or obligation prior to maturity thereof; and whether the lessee is authorized to withhold payments to the lessor for rentals, royalties, or other sums in satisfaction of the claim to reimbursement.

The warranty clause must be read in relationship to the granting clause and proportionate reduction clause. If the lessor owns less than 100% of the mineral interest, a granting clause that only describes the lands, but not the interest, is technically a breach of the warranty clause, but the proportionate reduction clause acts to proportionately reduce the lessor’s interest and the rental and royalties owed. If the granting clause describes the lessor’s percentage mineral interest in the lands, there is no breach of warranty, but there may be confusion as to the applicability of the proportionate reduction clause – is the lessor entitled to 100% of the rentals and royalties, i.e. not further proportionately reduced.

Cases have held that the warranty in the lease does not warrant the title of the lessor, it actually warrants title to the lessee. The warranty clause can be used to make a claim for a breach of warranty if the mineral interest covered by the lease is subject to an interest carved out of the mineral estate. For example, if prior to execution of the lease, the lessor’s mineral interest is subject to a non-participating royalty interest, it could be argued that the warranty clause, in some cases, results in the lessor’s royalty interest being reduced by the amount of the non-participating royalty interest.6

Many lessors will strike out or delete the warranty clause. As discussed above, legitimate reasons exist for using this clause. If the lessor insists on deleting the warranty clause, the lessee should at least propose one of the options for protection: make it a special warranty (“by, through and under”); limit the damages for a breach of warranty to money paid for the bonus, rentals, and royalties; or have the lessor execute an indemnifying division order in the event of production attributable to the leased premises.7 However, even if stricken, some courts have held that a warranty of marketable title is implied by law by use of the words “grant” or “convey” in the granting clause.

IV. Surrender or Release Clause8

The surrender or release clause was originally included in the “or” form lease to relieve the lessee of the obligations to either drill or pay rentals by allowing the lease to be surrendered back to the lessor. In contrast, the “unless” form lease permits a lessee to extinguish its obligations by merely failing to perform the obligation, i.e. lease will terminate unless rental is paid. However, a surrender clause is also useful in an “unless” form lease when the lessee desires to surrender only a portion of the lease. Following are two examples of a surrender clause:

- Lessee may, at any time and from time to time, deliver to Lessor or file of record a written release of this lease as to a full or undivided interest in all or any portion of the area covered by this lease or any depths or zones thereunder, and shall thereupon be relieved of all obligations thereunder arising with respect to the interest so released. If Lessee releases less than all of the interest or area covered hereby, Lessee’s obligation to pay or tender rentals and shut-in royalties shall be proportionately reduced in accordance with the net acreage interest retained hereunder.

- Lessee may at any time surrender or cancel this Lease in whole or in part by delivering or mailing such release to the Lessor, or by placing the release of record in the County where said land is situated. If this Lease is surrendered or cancelled as to only a portion of the acreage covered hereby, then all payments and liabilities thereafter accruing under the terms of this Lease as to the portion cancelled, shall cease and terminate, and any rentals thereafter paid may be apportioned on an acreage basis, but as to the portion of the acreage not released the terms and provisions of this Lease shall continue and remain in full force and effect for all purposes.

Of course, there are many variants of the surrender clause. As set forth in the above examples, a surrender clause may require that written notice be provided to the lessor and/or recording of the release. In some cases, the clause requires the notice be given at some particular date or after certain events have occurred (such as “after production is achieved”) or the surrender is not effective until some particular date after giving notice (such as “the surrender shall become effective 30 days after delivery of the release to Lessee”). The clause may also require a payment as a condition to the surrender.

As to partial surrenders, as provided in the examples above, if the lessee releases part of the lease, the lessee is relieved of all obligations concerning the released part, and rentals and shut-in royalties are proportionately reduced according to the amount of acreage released. However, some clauses specifically provide that certain obligations, including payment of rentals or royalties, will not be affected by a partial surrender. If a partial surrender is authorized, the size of the surrendered or retained lands may be addressed in the clause, i.e. “not less than ten (10) acres;” “contiguous;” or “any legal subdivisions thereof.” Including the phrases “at any time or times” or “may at any time, or from to time to time” clearly evidence that successive partial surrenders by the lessee are allowed. The lessee should include a provision that the partially surrendered lands shall remain subject to the easements and right-of-way provided in the lease for the lessee’s operations. Additionally, restrictions on the lessor’s or its subsequent lessee’s use of the surrendered land should be included stating that the lessor shall not interfere with the original lessee’s operations and requiring adequate set-backs from the exterior boundary of the lands retained or any well drilled by the original lessee.

V. Preferential Rights to Purchase and Options10

To protect the lessee, particularly with the advent of the short primary terms contained in contemporary leases, preferential rights to purchase and options to extend the primary term or renew the lease have been added to the lease. The following is a preferential right to purchase a new lease clause:

If during the term of this lease (but not more than 20 years after the date hereof) Lessor receives a bona fide offer from any party to purchase a new lease covering all or any part of the lands or substances covered hereby, and if Lessor is willing to accept such offer, then Lessor shall promptly notify Lessee in writing of the name and address of the offeror, and of all pertinent terms and conditions of the offer, including any lease bonus offered. Lessee shall have a period of 30 days after receipt of such notice to exercise a preferential right to purchase a new lease from Lessor in accordance with the terms and conditions of the offer, by giving Lessor written notice of such exercise. Promptly thereafter, Lessee shall furnish to Lessor the new lease for execution, along with a time draft for the lease bonus conditioned upon execution and delivery of the lease by Lessor and approval of the title by Lessee, all in accordance with the terms of said draft. Whether or not Lessee exercises its preferential right hereunder, then as long as this lease remains in effect any new lease from Lessor shall be subordinate to this lease and shall not be construed as replacing or adding to Lessee’s obligations hereunder.11

The twenty year limitation is to avoid a violation of the rule against perpetuities in some states. This provision provides that the new lease is subordinate to the old lease to avoid any question about the status of the new lease while the old lease is still in effect.

An option to extend the primary term may provide for the lease to be extended for a specified period of time upon payment of a specified consideration. For instance, the following is an option to extend the primary term:

Lessee is hereby given the option to extend the primary term of this lease for an additional Two (2) year(s) from the expiration of the original primary term hereof. This option may be exercised by Lessee at any time during the original primary term by paying the sum of One Hundred and 00/100 Dollars ($100.00) per net mineral acre to Lessor or the credit of Lessor mailed to Lessor at the above address. This payment shall be based upon the number of net mineral acres then covered by this lease and not at such time being maintained by the other provisions hereof. If, at the time this payment is made, various parties are entitled to specific amounts according to Lessee’s records, this payment may be divided between said parties and paid in the same proportion. Should this option be exercised as herein provided, it shall be considered for all purposes as though this lease originally provided for a primary term of Five (5) years.

A lease may also contain an option to renew the lease. Courts have differed on whether there is a distinction between “renew” or “extend.” In an Ohio decision, the court held that the clause “Lessor grants Lessee an option to extend or renew under similar terms a like lease” provided the lessee with two options: (1) to extend the lease on the same terms as the existing lease; or (2) to renegotiate for a renewal “like lease” on similar terms. The court reasoned that the terms “renew” and “extend” are distinct terms.12

In our Fee Lease 101 Series, we have covered most of the standard fee oil and gas lease clauses. As discussed above, these “left-over” provisions can affect the lessor’s and lessee’s, and their successor and assigns, rights, interests, and obligations and the status of the lease. A caveat for this article, and all our Fee Lease 101 Series articles, in interpreting any lease provision, care must be used in examining the specific language of the provision and the case law of the jurisdiction must be understood and applied. In order to avoid unintended consequences, the same caveat applies to drafting any lease provision.

1 See Pennaco Energy v. KD Co. LLC, 2015 WY 152, ¶ 19 (2015) (Finding, “Among the covenants [obligations] the original lessee-assignor retains after assignment of its interest are those requirement payments of rentals and/or royalties and restoration of the surface to its original condition once production activities have ceased.”).

2 Thomas W. Lynch, The “Perfect” Oil and Gas Lease (An Oxymoron), 40 Rocky Mtn. Min. L. Inst. 3-1, § 3.10 (1994).

3 See, generally, id. § 3.09.

4 See, generally, 4-6 Williams & Meyers, Oil and Gas Law § 685.1.

5 See, generally, Lynch at fn. 3, § 3.15.

6 Id.

7 Milam Randolph Pharo & Gregory R. Danielson, The Perfect Oil and Gas Lease: Why Bother!, 50 Rocky Mtn. Min. L. Inst. 19-29 (2004).

8 See, generally, 4-6 Williams & Meyers, Oil and Gas Law § 680.

9 The use of the terms “surrender” or “release” are used interchangeably to describe this clause. For purposes of this article, we will use the term “surrender”.

10 See, generally, 4-6 Williams & Meyers, Oil and Gas Law § 697.6.

11 See, generally, Lynch at fn. 3, § 3.17.

12 Kenney v. Chesapeake Appalachia, 2015 Ohio 1278 (Ohio Ct. App. 2015); Eastman v. Chesapeake Appalachia, 754 F.3d 356 (6th Cir. 2014).

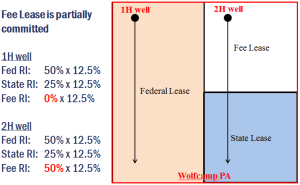

So what happens if the lessee’s working interest is committed to the unit agreement, but the lessor’s royalty interest is not? While the lessee will be allocated proceeds according to its proportionate share of the unit production area, the lessor will be allocated proceeds on a leasehold basis. This can result in a windfall either for the lessor or the lessee (compare the allocation of proceeds from the 1H and 2H wells in the diagram to the right, assuming 320 acre standup spacing units).

So what happens if the lessee’s working interest is committed to the unit agreement, but the lessor’s royalty interest is not? While the lessee will be allocated proceeds according to its proportionate share of the unit production area, the lessor will be allocated proceeds on a leasehold basis. This can result in a windfall either for the lessor or the lessee (compare the allocation of proceeds from the 1H and 2H wells in the diagram to the right, assuming 320 acre standup spacing units).