The terms “pooling” and “unitization” are often used interchangeably, but they have different meanings. Pooling is “the bringing together of small tracts sufficient for the granting of a well permit under applicable spacing rules,” while unitization is “the joint operation of all or some portion of a producing reservoir.”[1] While pooling and unitization are both used to prevent waste and protect correlative rights,[2] unitization works on a much larger scale, allowing an operator to maximize the amount of resources extracted from an entire field or reservoir, without regard to lease or property boundaries. Generally, the lessee of a fee (private) oil and gas lease is free to commit its working interest to the unit agreement, but the lessee can only commit the lessor’s interest through voluntary ratification, compulsory unitization, or a unitization clause. This article will focus specifically on the third option: the unitization clause in fee leases.

Unitization clauses (if included at all) generally follow two patterns. First, the unitization clause may be interwoven into the pooling clause. Second, the unitization clause may appear separately, often immediately following the pooling clause (we believe this to be the preferred method). There are typically four parts to a “standard” unitization clause.

Part One – When can the lessee unitize the lessor’s interest?

Example: Lessee shall have the right to unitize, pool, or combine all or any part of the leased premises with other lands in the same general area by entering into a cooperative or unit plan of development approved by any governmental authority.

The unitization clause should expressly grant to the lessee the authority to unitize the leased premises under a cooperative or unit plan of development. Depending on the type of unit being formed (for example, a federal exploratory unit or a state voluntary unit), the language should be broad enough to cover the proposed plan of development. Because the lessee may not know its future unitization plans at the time it negotiates a lease, the lessee should ensure that the unitization clause is broad enough to cover all forms of unitization.[3]

Even with a unitization clause, the lessee has an implied duty of good faith and fair dealing when pooling or unitizing a fee oil and gas lease.[4] This means that the lessee should be careful when attempting to commit a lease that is about to expire or includes non-productive lands, or when the lessee’s economic interests are not aligned with those of the lessor. However, if the unit plan of development is approved by a governmental entity (such as the BLM or the state conservation commission), courts will generally defer to the government’s approval in determining whether the lessee acted in good faith.[5]

Unfortunately, when describing how the leased premises can be unitized with other lands, it is not uncommon to find combined pooling/unitization clauses where the lessee mistakenly used pooling language (such as “into a drilling or spacing unit in conformance with a state drilling or spacing order”) instead of replacing it with unitization language (such as “to one or more unit plans or agreements for the cooperative development or operation of one or more oil and/or gas reservoirs or portions thereof”).

Properly drafted unitization clauses should cover the development of a field or reservoir as opposed to just those lands within a single drilling or spacing unit.

Part Two – How will the terms of the lease be affected?

Example: When such a commitment is made, this lease shall be subject to the terms and conditions of the unit plan or agreement and this lease shall not terminate or expire during the life of such plan or agreement.

To effectively extend the lease under the unit plan of development, the lease terms should be amended to conform to those of the unit agreement. This can be done either by having the lessor ratify the unit agreement or by including express language to that effect (such as described above) in the unitization clause. This will ensure that the lease won’t expire while the operator of the unit is actively engaged in drilling operations under the unit agreement.

Conforming the lease to the unit agreement may not be the end of the analysis in terms of lease extension. Specifically, all or a portion of the leased premises could still expire if the lease contains a severance provision in the unitization clause or a separate Pugh clause. A severance provision in a unitization clause could result in lease expiration as to any non-unitized lands at the end of the primary term. For example:

Anything in this lease to the contrary notwithstanding, actual drilling on, or production from, any unit or units (formed by private agreement or by any State or Federal governmental authority, or otherwise) embracing both lands herein leased and other land, shall maintain this lease in force only as to that portion of Lessor’s land included in such unit or units, whether or not said drilling or production is on or from the leased premises.

Similarly, a Pugh clause could result in lease expiration as to any non-producing lands at the end of the primary term. For example:

Notwithstanding any provision to the contrary, this lease shall terminate at the end of the primary term or any extended term, as to all the leased land except those lands within a production or spacing unit prescribed by law or administrative authority on which is located a well producing or capable of producing oil and/or gas or lands on which Lessee is engaged in drilling or reworking operations.

The threat posed by either of these provisions requires careful review of the lease as a whole. Oftentimes, Pugh clauses are negotiated independently of the general lease terms and ultimately included on an addendum attached to the lease. As a result, they are not always consistent with the other terms of the lease. To avoid ambiguity, when negotiating a fee oil and gas lease, it is prudent to review any included Pugh clause (and all other lease terms) and consider how it will reconcile with the unitization clause. Ideally, the Pugh clause should only result in lease expiration as to those lands outside of an approved unit. However, at a minimum, the Pugh clause should be drafted (or amended) so as to not sever the lands within a unit production area (for example, a participating area in a federal exploratory unit).

Part Three – How will the lessor’s royalty interest be calculated?

Example: Where there is production on any particular tract of land covered by such plan, it shall be regarded as having been produced from the particular tract of land to which it is allocated and not to any other tract of land and the Lessor’s royalty interest shall be based upon production only as so allocated.

Generally, a pooling clause will allow the leased premises to be combined with other lands to form a drilling unit, wherein proceeds from production anywhere on the drilling unit are allocated according to the percentage of the acreage of each tract divided by the total acreage of the drilling unit. However, because units are concerned with the development of a field or reservoir, the unitization clause should provide that proceeds from production should only be allocated to that tract included in a unit production area (such as a participating area in a federal exploratory unit). In other words, if the lessor’s interest is properly committed to a cooperative or unit plan of development, production anywhere on the unit will hold the lease, but the lessor will only receive proceeds from production if its tract is included in a unit production area containing a producing well (not the drilling or spacing unit that would exist if the well was drilled outside of the unit).

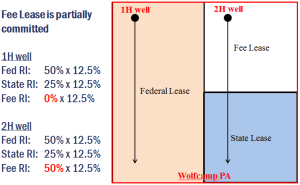

So what happens if the lessee’s working interest is committed to the unit agreement, but the lessor’s royalty interest is not? While the lessee will be allocated proceeds according to its proportionate share of the unit production area, the lessor will be allocated proceeds on a leasehold basis. This can result in a windfall either for the lessor or the lessee (compare the allocation of proceeds from the 1H and 2H wells in the diagram to the right, assuming 320 acre standup spacing units).

So what happens if the lessee’s working interest is committed to the unit agreement, but the lessor’s royalty interest is not? While the lessee will be allocated proceeds according to its proportionate share of the unit production area, the lessor will be allocated proceeds on a leasehold basis. This can result in a windfall either for the lessor or the lessee (compare the allocation of proceeds from the 1H and 2H wells in the diagram to the right, assuming 320 acre standup spacing units).

Part Four – How can the lessee commit the lessor’s interest?

Example: Lessor shall formally express Lessor’s consent to any cooperative or unit plan of development by executing the same upon request of Lessee.

The mechanism for the lessee to commit the lessor’s interest to a cooperative or unit plan of development varies depending on the unitization clause. Many unitization clauses allow the lessee to unilaterally commit the lessor’s interest by executing the unit agreement. In some cases, such unitization clauses require the lessee to record a memorandum of the unit agreement. Other unitization clauses, such as the example above, require the lessor to formally consent to the unit plan of development when requested by the lessee. This is typically done by executing a ratification of the unit agreement. In any event, the agency administering the unit (for example, the BLM for a federal exploratory unit) may need to confirm the commitment status of the fee lessor. As such, and to avoid a potential dispute down the road, the lessee may decide to obtain the lessor’s ratification of the unit agreement, even if the terms of the lease do not require it.

Unitization Clause Checklist:

- ✓ Is there a unitization clause?

- ✓ Does the unitization clause cover the proposed type of unit?

- ✓ Does the unitization clause allow the leased premises to be combined with other lands for the development of a field or reservoir (as opposed to a single drilling unit)?

- ✓ Does the unitization clause amend the lease terms to those of the unit agreement?

- ✓ If there is a severance provision in the unitization clause, will it impact the proposed operations?

- ✓ If the lease contains a Pugh clause, is it consistent with the unitization clause? Will it impact the proposed operations?

- ✓ Does the unitization clause allocate proceeds from production within the unit production area (as opposed to a drilling or spacing unit)?

- ✓ Will the proposed unitization plan be exercised in good faith?

- ✓ If required, did the lessor execute a ratification of the unit agreement? Was it recorded?

[1] Williams & Meyers, The Law of Oil and Gas, § 8-U.

[2] In Utah, for example, correlative rights are defined as “the opportunity of each owner in a pool to produce his just and equitable share of the oil and gas in the pool without waste.” Utah Code Ann. § 40-6-2(2).

[3] See, e.g., Trans-Western Petroleum, Inc. v. U.S. Gypsum Co., 584 F.3d 988 (10th Cir. 2009).

[4] See, generally, Williams & Meyers, The Law of Pooling and Unitization § 8.06.

[5] See Amoco Prod. Co. v. Heimann, 904 F.2d 1405 (10th Cir. 1990).

Co-Authors

David Hatch and Andrew LeMieux